With recent closures on the high-street and a growing list of online outlets, fashion retail has never been so competitive. In a world of hyper-adoption and hyper-abandonment, good customer experience is vital during every part of the customer journey. Both digital and physical touchpoints must work together seamlessly to create customer satisfaction and maintain customer loyalty. There is so much choice in the fashion industry which means brands must compete to provide the best retail customer experience.

According to Forrester “Emotion accounts for nearly half of the energy that a brand accumulates. Few brands actively measure emotion or don’t deeply understand the drivers behind their customers’ emotion.” At Adoreboard we use emotion analysis to reveal unknowns from customer data to deliver decision-ready insights to compete in Retail Customer Experience.

We analysed customer commentary of 30 of the biggest UK fashion retail brands online and physical stores. Over 600,000 mentions were gathered from 1st January to the end of November. Our team of data analysts analysed the customer data through our emotion analytics engine Emotics to uncover the key emotions determining customer experience for each of the retailers. Our analysis was able to pinpoint certain stages in each customer journey that were driving good and bad customer experience.

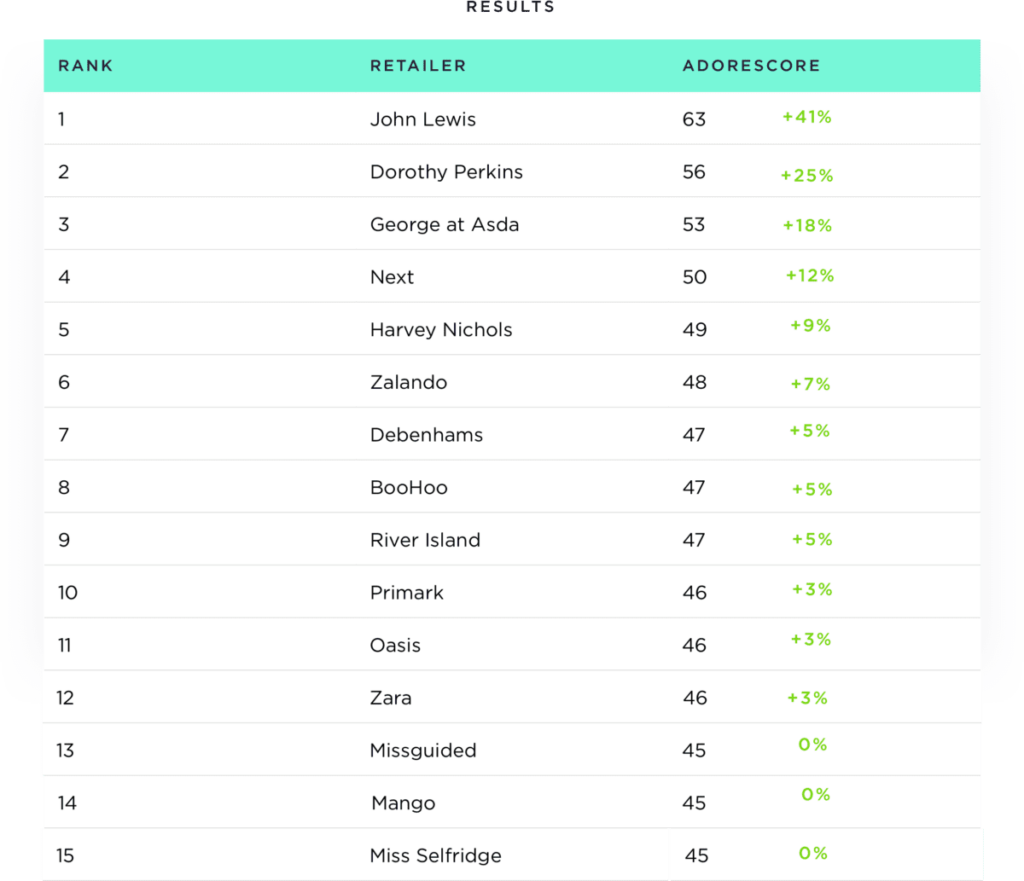

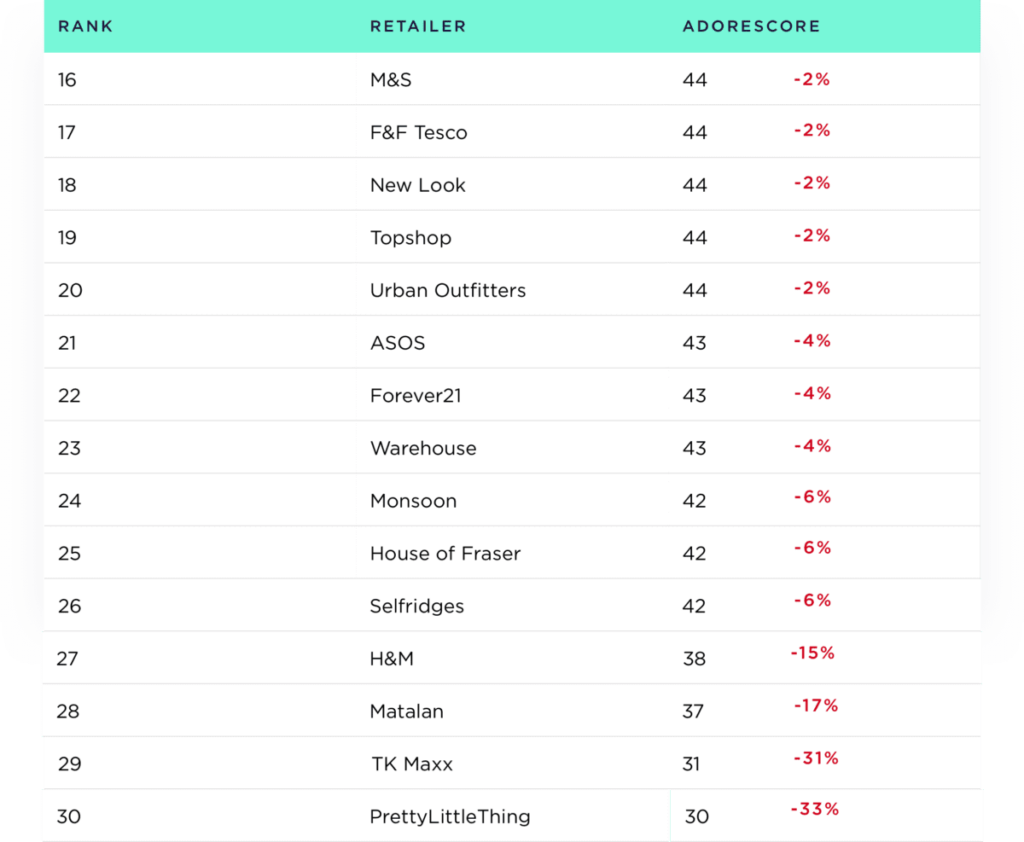

The Results

The retailers were ranked by their Adorescore, which is a metric which allows you to understand how well or badly a brand is performing. Based on an Index of -100 to +100 you can gauge quickly if a brand is adored or floored. The Adorescore should be used as a signpost to understand the directional view of overall performance.

The green and red numbers represent the difference from the industry average to give you an idea of how they are performing relative to the industry.

The Leading Brands In Focus

John Lewis

Department store John Lewis topped our analysis with an Adorescore of 63 and a score of 77/100 on the Joy Index. This is a whopping 41% more joy than the average of all retailers in the analysis.

The much publicised and anticipated Christmas advertisement drove high levels of joy to the brand. This year’s ad featuring Elton John has had mostly positive reactions.

“Absolutely fantastic, was smiling all the way through it! Well done!” OMG has anybody seen the new @jlandpartners advert. Well done!”

Mentions of good customer service provided by the John Lewis online customer service team led to high admiration and trust. The quick and friendly response from the team has a positive impact on Customer Experience.

“@jlandpcustserv Thanks, Matthew, very kind. I’ll do that when I get back.”

Competitions and partnerships with brands such as DK Books or Southern Home Own created a buzz of social media engagement which generated high Interest towards the brand.

Next

Fashion brand Next came fourth place in our analysis with an Adorescore of 50, which is 12% above the industry average. They were the second highest retailer on the Joy Index with 7% more joy than competitors.

The Next brand accumulated a lot of joy and trust due to influencer outreach. Bloggers and online creators with a high reach and engagement are likely to drive positive emotions to the brand, proven by Next’s high rank in our analysis.

“I’ve been obsessed with this jumper from @nextofficial It’s honestly the softest thing I own and it makes the perfect lazy day uniform ✨ #fbloggers

Next have also hit the mark by providing high quality and aesthetically pleasing ranges. Mentions were especially high for the home and baby ranges which dominated the data.

“absolutely loving next homeware for decor bits at the moment! How lovely is this little trinket dish?? perfect for any loose jewellery/change!”

The Lagging Brands in Focus

Pretty Little Thing

Online fast fashion brand PrettyLittleThing placed last in our analysis with high levels of anger and sadness driven towards the brand. Anger was 35% higher than competitors included in the analysis. An Adorescore of 30 and an anger score of 25 was garnered mainly due to high levels of customer frustration regarding lack of customer support online. High volumes of customers were taking to Twitter to complain about delayed responses to queries or complaints online.

“What’s the point of having a customer service email if you don’t even reply? 5 days and still no reply. Let down countless times by you”

Issues with lost returns and delayed deliveries also angered customers. Another emerging theme was stock issues with customers paying for items to be later told via email that the item was later out of stock.

“I’ve just gotten an email saying an item I’ve ordered is out of stock, then gone onto your website & it’s in stock in my size… why have I not been sent it then if I’ve paid for it!”

“Pay £5.99 for next day delivery to receive an email saying it won’t be here until tomorrow. Not impressed”

These issues need to be resolved in a more timely matter and stock organisation needs to be improved in order to maintain and improve customer loyalty.

House of Fraser

House of Fraser also placed low in our analysis and one of the brands driving the most sadness (30% higher sadness than the industry average). The department store has had some significant changes this year with threats of store closures and change of ownership. The brand earned a low Adorescore of 42 and a high sadness score of 32.

The negative publicity surrounding the new owner Mike Ashley has driven high sadness towards the brand with some people going as far as to boycott the brand.

“No one should ever use @houseoffraser or @SportsDirectUK or any company owned by Mike Ashley again”

Gift cards being cancelled and refunds being lost or refused led to high anger and sadness being felt among customers. Many claiming the brand owes them hundreds in refunds made after the ownership change.

“still waiting on my refund of £127.50 for suit items ordered online and returned in good faith for my money back. Furious.”

Key Takeaways

1. Maximise Brand Experience

The sum of CX initiatives plus marketing activities provide a combined perception of brand. Retailers should maximise their influencer engagement, competitions and brand events to drive positive conversation around the brand.

2. Remove CX Friction Points

Retailers should map out key touchpoints in the customer journey that lead friction in customer satisfaction. Delayed deliveries, rude staff and slow response to customer queries are examples of CX friction points.

3. Optimise Product Experience

Brands should understand how people interact with their products to create brand advocates. Customers who share images or praise the quality of products or ranges online will spread positivity and drive advocates to your brand.

This blog post only provides a snapshot of the analysis of each brand, if you would like a more detailed analysis of your brand or a competitor please get in touch here.