Healthcare insurance isn’t exactly known for clear, feel-good experiences. Ever get lost somewhere between a pending claim and a hold music marathon, wondering where your money went? You’re not alone.

Brett Kiley, who’s spent two decades steering customer and patient experience at giants like CVS Health, now helps reshape US healthcare at Cyclam, a global AI company working across 14 countries. His journey covers strategy, client retention, and hundreds of millions in revenue. When Brett talks about member experience, you want to listen.

Let’s dig into what the top healthcare insurers get wrong, what a few get very right, and (more importantly) how CX pros can turn experience into real revenue.

Experiences That Drive (Or Lose) Billions

Healthcare insurance costs have shot up while patient outcomes slid off a cliff. That’s not just a graph; it’s the daily reality for both customers and payers. Organizations are scrambling to flip that story — to make revenue rise with experience, not against it.

Key idea: If you want the board to pay attention, connect customer experience to money. CX is not an expense to cut — it’s an investment. That shift unlocks senior buy-in and real action.

“Building a good CX program and really understanding what it’s telling you to do — and actually doing it — is a true competitive advantage just waiting to happen.” — Brett Kiley

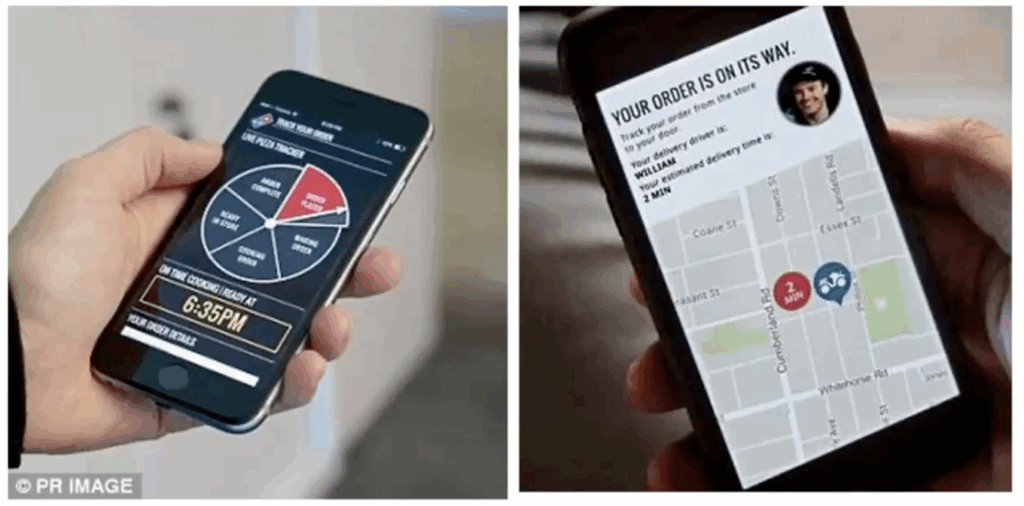

Why Can’t My Insurance Experience Be Like Domino’s?

Brett isn’t afraid of pizza analogies. If you can follow a pizza from “order received” to “out for delivery” in real-time, why can’t you do the same with a prescription or a claim? Software has made everything else more transparent — but insurance still sends you the occasional mystery bill.

Healthcare insurers are like cruise ships: comfortable, impressive, but impossible to turn fast. With AI and the right tech, CX shouldn’t be a cruise ship but a speedboat — nimble and ready to change direction.

Speedboats, Not Cruise Ships: The Case for Agile CX

AI wasn’t on most roadmaps a few years ago. Now it’s everywhere. Every executive asks what AI can do for their patient experience, but most still just listen to feedback. Acting on it? That’s where things break down, even in big firms (Brett has seen it firsthand, at all levels).

90% of CX programs collect feedback, but 83% can’t connect their actions to financial outcomes.

People tend to treat CX like renting a flat. 🏚️

If costs go up, they move out.

What’s needed is an owner’s mindset — invest, improve, and grow value. 🏡

Companies that do this see retention, ROI, and loyalty spike.

Data-Driven CX: Finding the Revenue At Risk

How do you tie experience directly to dollars?

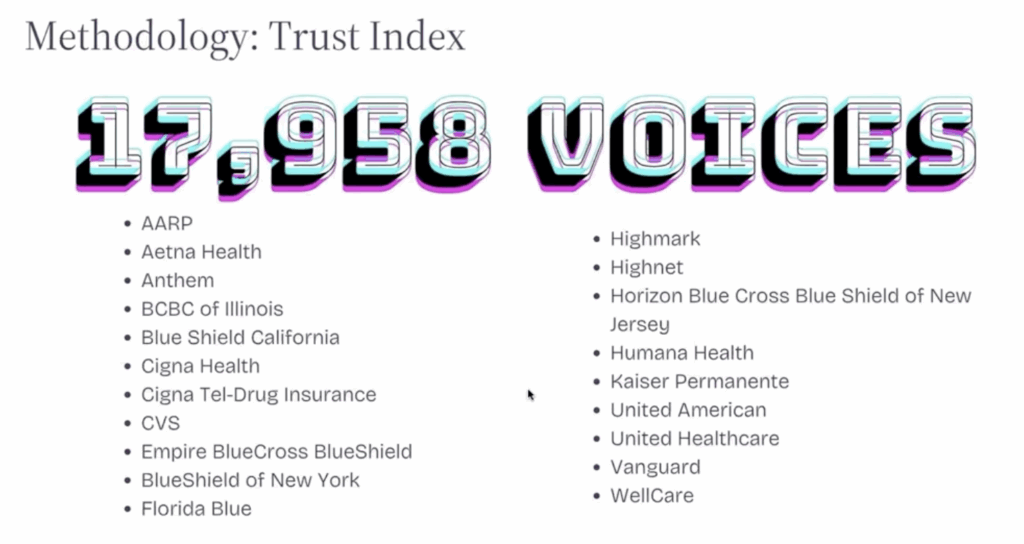

Brett’s team looked at 17,958 real feedback responses across 20 US health insurers. That’s over 21 million customers, spending an average $8,000 a year for their insurance.

Using AI, they can analyze 1,000 comments in under 30 seconds. Trends and themes pop out — with dollar values and revenue risk attached, revealing a Trust Index.

One stat to grab attention: Across those firms, the revenue risk was $352 billion.

How?

Simple calculation: Each unhappy customer can jump ship, and acquiring new ones isn’t cheap.

The Six Big CX Drivers For Health Insurers

Across all that feedback, six themes predict customer trust and loyalty. (And by extension, revenue.)

1. Transparency on Insurance Claims

People feel lost. Denied claims, unclear rules, slow answers. It creates instant buyer’s regret.

Customers want to know what’s covered, why something isn’t, and what they can expect.

Lack of transparency is the top driver of lost trust. It’s not even close.

“You trust your doctor, maybe your spouse, but your insurance company? If you can move that needle, even a little, you win big.”

— Brett Kiley

2. Prescription Struggles

If getting life-saving meds means battling phone hoops and unclear pre-authorizations, trust falls apart.

54% of feedback on prescription issues reveals lower trust.

Getting this right isn’t just CX — it’s positive for the bottom line.

3. Communications On Claims And Delays

People will wait, but only if you tell them what’s going on.

Long hold times, transfers, and “I don’t have that information” moments drive customers away.

“Voting with your feet” is real: patients leave after bad interactions.

4. Bad Customer Service (When It Matters Most)

The bar is (sadly) low, and most negative feedback centers here.

Often, it’s not the rep’s fault; they’re just not equipped with the right data or authority to solve problems.

Training on empathy is good, but without matching information, it won’t save loyalty.

5. Triage: Urgent Help Requests

When you’re desperate, being routed through a maze destroys trust.

Especially critical for mental health or time-sensitive medication issues.

Smart triage (AI, prioritization) can separate routine calls from emergencies instantly.

6. Poorly Functioning Digital Channels

Broken apps and portals mean more calls, more frustration, and lower NPS.

People would prefer to self-serve — but only if digital touchpoints actually work.

Fixing CX: From Idea To Action

Pulling feedback is easy. Fixing the real issues, not so much. Here’s where most insurers get stuck:

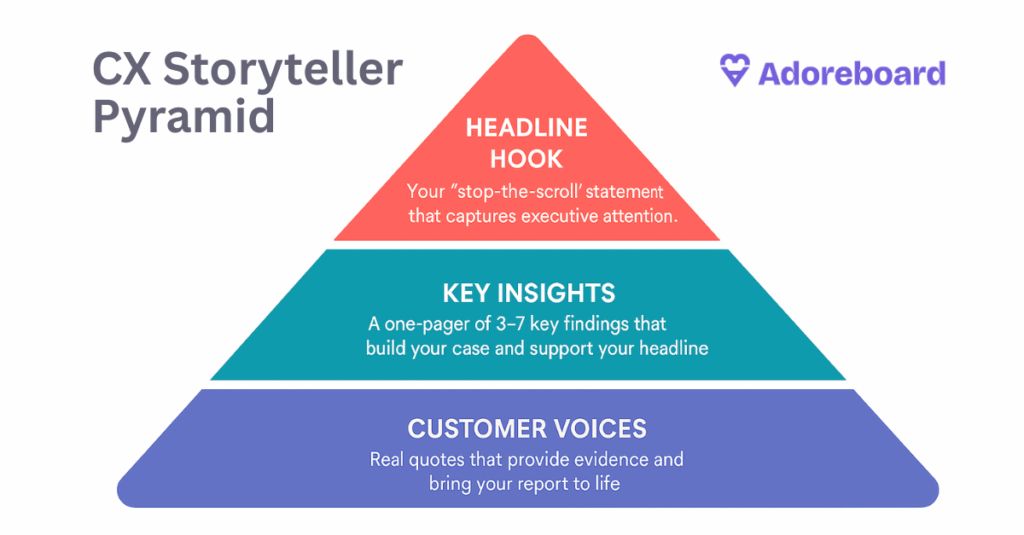

Listening, but not prioritizing. CX surveys pile up. Turning “what happened” into “what should we do” — that’s the missing link.

Targeting the wrong numbers (NPS, CSAT) and losing sight of churn or lifetime value.

Focusing on the symptom (“too many calls about late prescriptions”) instead of the root cause (a broken claims flow, for instance).

Brett uses the phrase: Follow the breadcrumbs. Don’t fix the first thing you see. Ask, what’s causing those issues in the first place? (Usually, a handful of problems drive 80% of feedback.)

You can watch / listen to the full webinar above!👆

Let’s Talk Tech: AI, Personalization, and Real-Time Service

Modern technology means the future is here — not five years out, but right now.

AI can bucket and route calls by urgency, topic, or customer value. No more treating your top-spending client the same as a first-timer.

Large Language Models (LLMs) learn from every call. “Why is my prior auth missing?” — if it’s come up before, the system suggests smart answers and next steps for both rep and customer.

Personalization isn’t just a nice-to-have. Know who’s calling, why, and what problems they’ve had in the past, then use that to deliver empathy and speed. “Show me you know me” is huge.

Automate simple stuff. If the app is broken, fix it. If somebody wants a text, send a text. Free up human reps for tough cases that need care.

“People who don’t want to talk would love a voice bot that works. Others need a human. Meet people where they are. And for the rest, empower your staff with knowledge and empathy.” — Brett Kiley

How To Make CX A Profit Center

Most executives see CX as a line item — something to trim, not expand. When you can tie CX investments directly to revenue retention (or growth), everything changes.

Put real dollar values on churn and loyalty.

Measure the impact of fixing a frustration (“If we cut time-to-resolution, how many customers do we keep? What’s their lifetime value?”)

Senior leaders respond when you move from “scores” to “savings and growth.”

“Turning CX into a financial conversation is the missing link in so many programs. That’s how you get budget and leadership buy-in. Small changes can mean big money.” — Brett Kiley

Take The First Step: Don’t Boil The Ocean

Looking at 20+ problem areas is overwhelming. Here’s Brett’s advice:

Use the right discovery tools to surface ALL known and unknown issues (see AI-powered analytics — that’s where Adoreboard shines!).

Don’t try to fix everything — most challenges trace back to 2-3 root causes.

Prioritize issues by the impact on revenue and trust — not just how often they appear.

Start with proven, not experimental, solutions — especially in healthcare, where mistakes hit harder than in other industries.

Pilot, measure, expand. Wins build trust with the board and with customers.

The Five Pillars For Better Healthcare CX

Across all the chatter, Brett lands on five pillars that matter most:

Convenience: Digital channels that work; easy access to information.

Quality: Deliver what you promised; get the basics right.

Support: Solve problems fast, using both tech and empowered people.

Personalization: Make people feel known, not like a number.

Communication: Set expectations, keep customers in the loop, act with transparency.

Solve even a couple of these, and feedback — and revenue — will move.

Connect with Brett on Linkedin: https://www.linkedin.com/in/brettkiley

New Mindset: Move from Reactive to Proactive

Stop patching leaks. Build a better roof.

Most insurers have big escalation teams — but barely anyone focused on proactive solutions.

Fix problems before they hit the phones.

This is about a cultural change: stop thinking “that’s just the way it is.” Customers expect better. So do competitors.

“A speedboat, not a cruise ship. Companies that embrace the shift, and lead by doing, will pull ahead. The rest… could get left behind.” — Brett Kiley

Quick Wins—And The Power of Experimentation

Healthcare moves slow, but tech doesn’t wait. That’s why “experiment, but don’t gamble” is the watchword.

Try new digital flows where you won’t hurt patient safety.

Prove out ROI, then double down where it works.

Don’t invest in twenty bandaids — fix three sources and get results everywhere.

Personalization and hyper-personalization are more than email first names. Knowing histories, likely problems, and preferred channels is the new bar.

“Having someone who can work inside the regulatory rules — and keep things safe — is key. The upside is huge if you do it right.” — Brett Kiley

The Gift: A Free Revenue-at-Risk Report

Adoreboard’s offering: a free “revenue risk” report with your company’s scores against national benchmarks, plus Brett’s expert commentary.

Want it? Just ask. (It’s how Brett and the Adoreboard team met.)

Final Reflections: Raise The Bar

Healthcare CX lags most sectors. Forrester’s latest “total experience” metrics are down almost across the board. But disruption is here. Digital-first companies will eat the slow ones. The time to raise standards is now — using the language of revenue risk, not just “surveys” and “insights.”

Main Takeaways From Brett Kiley

Connect every CX effort to dollars, not just NPS/CSAT

Start small: Fix two or three big issues, not fifty symptoms

Use real-time analytics (like Adoreboard) to surface priorities

Invest in AI and proven tech for triage, personalization, and automation

Train for empathy, but also empower teams with the right data

Move from reactive (complaint solving) to proactive (problem preventing)

Know that small changes in CX drive big changes in revenue and loyalty

If you want real action on member experience — not just another survey deck — take inspiration (and practical moves) from Brett’s playbook. Make CX the reason customers stay, not the reason they leave. Your revenue will thank you.

Want to benchmark your own CX? Reach out for your free Adoreboard “revenue risk” report with Brett’s commentary.

Let’s get your speedboat ready! 🚀