Despite high-street issues, research has found that millennials still prefer to shop in-store rather than online. But why? Online shopping is more convenient and often has a wider range of products compared to high-street retail stores. Well, the largest ever fashion retail survey reveals that 18-34 year olds still prefer the human touch.

Millennials prefer real-world experiences

Adoreboard, in collaboration with OnePulse, gathered data and analysed emotional responses expressed by 10,000 millennial consumers about their shopping habits, preferences and brand rankings, to help retail brands provide a better customer experience.

We found that 49% of 18-34 year olds say they prefer to shop for clothes in store, compared to 11% who prefer apps, and 39% who use websites. An overwhelming 76% of millennials say they prefer human assistance online over chat bots, suggesting that AI support does not generate as much brand trust as real human interactions.

What we found out…

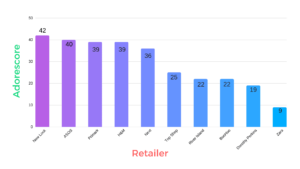

So, what has Emotics uncovered for us, and what does our Adorescore say for these top retail brands? Online retail is said to reach £36.2 billion by 2030: 63% of the market compared to today’s 21%. However, big-brand online retailers such as ASOS and BooHoo are rated lower than the high-street chain New Look. This begs the question, is it all about ‘the experience’ for millennial shoppers?

A2. The experience! Whether you are shopping online or at a brick and mortar location, it is all about the shopping experience #bizheroes

— Chelsea Krost (@ChelseaKrost) October 17, 2017

In fact, despite its recent reported financial trouble and rumoured store closures, New Look comes out on top over the 10 fashion retail brands analysed. New Look’s Adorescore sits at an impressive 42, despite sharp competition from ASOS, who scored 40.

Adoreboard’s CEO, Chris Johnston, mentions that “there is stiff competition to win the hearts of the Millennial consumers who desire on-trend fashion, balanced with quality and value for money”. “New Look’s efforts to appeal to younger shoppers is reflected in strong ‘Trust’ in providing affordable fashion, whilst ‘Joy’ has been driven by how Millennials rate the in-store customer experience. However, many would argue that the allure of appealing to Millennials has come at a cost of alienating core customers, and is reflected in plummeting sales for New Look”.

Meanwhile, ‘Anger’ and ‘Sadness’ frequently emerge when analysing H&M through Emotics, as customers continue to complain about their sizing issues. It comes as no surprise, then, that millennial shoppers rejoice at the news of H&M’s recent announcement about reviewing its sizing. Similar emotions are expressed by millennial shoppers when looking at Topshop, one of fashion’s favourites. Topshop’s Adorescore is also particularly low due to their small sizing.

What means most to millennials?

Personalised customer service, value, affordability and ethics are among the biggest motivators for millennials when retail shopping. And these are the factors that guide the prevailing higher scores of New Look, Primark, ASOS and H&M.

Nearly two thirds (61%) of millennials say that ethics and sustainability are key when shopping for clothes, compared to 26% who were undecided and 12% who said ethics isn’t important to them.

At the other end of the scale, brand trust is compromised if the retailer offers poor quality products and sizing issues. These problems rank highly for River Island, BooHoo and Zara.

What about trust?

61% of Millennial fashion retail consumers don’t trust direct brand marketing. This could be down to millennials searching for authentic experiences, and mostly getting in-your-face ads – 65% of those surveyed said that they are less likely to trust brands that bombard them with ads.

An impressive 85% of 18-34 year olds say that social media influences their fashion buying decisions. Millennials now look to peer-to-peer communication, such as online reviews or Instagram influencers, for fashion information and advice over traditional marketing.

Chris Johnston adds to this: “Brand marketers need to work smarter to start a dialogue with younger fashion retail consumers who are turned off by overt brand messaging. We know that they like to be in control of their consumer choices more than any other age group, and to feel part of a one on one, authentic conversation. The analysis notes that 85 per cent of Millennials say that emotion influences their purchase decisions, so marketers need to work smarter to build new experiences and retail theatre to heighten the appeal to these new types of shoppers.”

Chris added: “There’s been a lot of comment recently about the high street business model failing customers. But our Report proves that Millennials – those consumers whose spending power will drive retail and brand performance over the next generation – want, need and value that in-person, human, individualised experience.

“So, what does this tell brand marketers? Direct, one-to-one communication is key, as is providing a seamless customer experience from online to in store. There’s too often a disconnection between the value and convenience provided online with the levels of service and overall experience you find in store – and that experience is the high street’s key differentiator.

Putting the customer at the heart of your brand decisions is vital for brand survival and future growth. Exploring customer feedback through an emotional lens allows brands to generate more trust and build a seamless CX across every consumer touch point.”