Customer experience has changed radically due to the consumerism of software. Expectations are now set through the lush interfaces of Apple, the immediacy of Uber and the variety of Amazon. Firms with slower existing processes are struggling to keep up. Standard customer service has been turned on its head as customer expectations have fundamentally shifted. The companies that continue to win are the ones that have started from a blank sheet and designed with digital processes in mind and a customer understanding around how consumers act, think and feel.

Workplaces have evolved in a similar way and emerging digital processes have been a major disruptor. Artificial Intelligence is being applied to the coalface of business workflows at every vertical leading to changes, new and redundant roles in the workplace. Just think of the number of self-service checkouts in supermarkets or check-ins in airports.

New expectations have been set not only by digital but by the changing profile of the workplace. The Financial Times predicts that by 2020 35% of the workforce will be aged between 18-32. The Millennial age group have grown up with technology and immediacy that they have changing priorities when it comes to the workplace. Employers must continue to update their processes and move with the shifting profile of employees. Measuring human emotion is an emerging way to understand both customer and employee experience and pinpoint areas of improvement and development.

Pensions?

Take pensions as an example, pensions are considered ‘boring’ and often an afterthought but our research has revealed they are now a key consideration for young people today. In 2012 the UK government introduced auto-enrollment of pensions and by 2018 all-new employers had to enrol their employees and contribute towards it. Suddenly, pensions were on employees radar through receiving pension statements from employers outlining their individual pension fund and how it’s being invested.

It is the employer who has the choice into what pension fund they invest their employees’ money. This decision can have huge implications as our insight discovered.

We partnered with Franklin Templeton to uncover how the younger demographic feel about pensions and responsible investment. They wanted to find out what employers and pension providers could do to enhance the offering and the experience for the UK workforce.

We surveyed over 2700 people aged between 21 and 38 who were in full-time employment and living in the UK. They were asked a series of questions about their workplace through a mobile-based survey app. The responses were analysed through Emotics, our emotion AI platform, to extract the key emotions felt by respondents. The survey was also supplemented with analysis of social media commentary in relation to the issues that people reported they cared about, to further assess the discourse among this generation.

The analysis found that:

- Pensions drove intense emotion but they were not aligned with the Millennial values.

- Financial values are important, employees feel valued if they feel their future is being invested in.

- Responsible investment in areas such as climate change draws out strong emotions and present a powerful engagement opportunity.

- Responsible investment can be a catalyst to encourage the Millennial employee to put more into their pension.

Misalignment

The analysis revealed that the discussion of pensions drives intense emotions. When asked: “How do you feel about your workplace pension?” 19% of respondents expressed higher intensity emotions both positive and negative towards pensions compared to 11% high-intensity emotions when discussing a well known high street retailer. This shows how important the financial future of pensions is to employees. However, the majority of respondents did not feel that their pensions reflect their values – only 22 per cent felt that they did. Interestingly, sadness and disgust were the main emotions emerging when pensions and values were discussed.

“My pension doesn’t reflect these values as the money isn’t being invested in funds or companies that use the money to benefit the environment in some way”

Financial Value

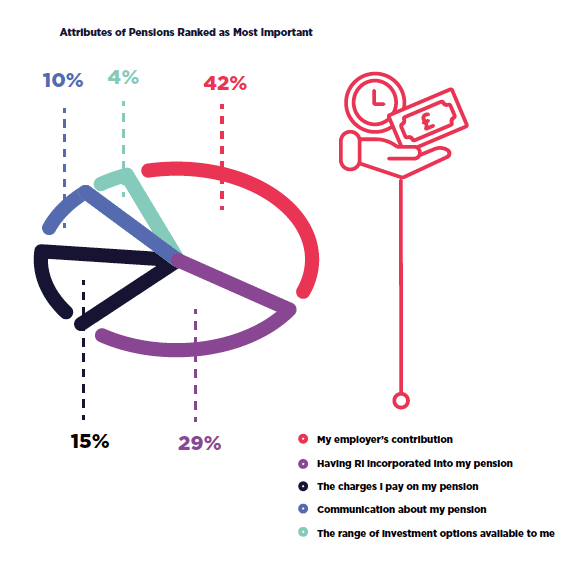

As pensions are created to finance retirement, it is no surprise that financial value is important to employees. In fact, 42% of respondents ranked financial value as the most important attribute of pensions. Closely followed by 29% who ranked responsible investment as the most important attribute. By considering these two areas of importance employers can increase positive emotion throughout their workforce.

“I like the contribution my employer makes and I like seeing my money build”

Responsible Investment

The research shows that Millennials respond positively and with high-intensity emotions to responsible investment issues, especially climate change. 55% of respondents said climate change was important to them closely followed by animal welfare (48%) and plastic waste (41%).

“Looking after the environment is high on my scale of personal goals, therefore, would be great as a responsible investment”

Companies investing in these issues will have a positive impact on the evaluation of companies. Negative attributes of companies expressed by respondents included tax avoidance, animal testing and environmental damage.

Responsible investment is a strong motivator for the Millennial age group with 45% of respondents reporting that they would pay more (1 to 3% extra) towards their pension if they knew it was being ethically and responsibly invested by their employer. This could prove massive as based on the responses Millennials alone would be willing to add an additional £1.2 billion in additional pension contributions per annum.

“I trust responsible investment will give me better returns for the future, plue it is also contributing to a greater cause”

Implications on Employee Experience

Pensions are just one example, but the implications could be massive if employers could measure and align their investment practices with employee values. Understanding the emotional drivers can change workplace behaviour. In the case of pensions, potentially adding billions to the future pension of young people.

Designing new processes and practices with the employees’ values in mind can transform the future of business. Measuring the emotion and therefore the humanity of what links the employee to the customer can benefit business prosperity and the bottom line.

Want to see further results from the research with Franklin Templeton? You can download the full research report below.