New research on the level of customer experience provided by UK high street banks reveals that TSB has the happiest customers!

TSB, M&S Bank, Monzo, Metro and First Direct are among the best service providers, based on an analysis of emotions contained in Tweets sent to the banks by customers.

Our analysis found that M&S Bank drove the highest levels of trust, whereas TSB and Metro inspired the most joy amongst customers.

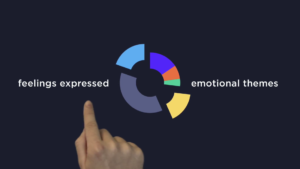

Here at Adoreboard we used mathematical algorithms to detect emotions such as Joy, Trust, Rage and Anger expressed by people posting online. We used our emotion analysis tool Emotics to analyse over 67,000 tweets by customers with accounts at 22 banks over a six-month period.

Customers expressed highest levels of joy and trust for banks with fast and efficient service as well as charitable efforts.

Smile, the on-line UK bank from the Cooperative Bank had the worst customer experience driving the most anger and sadness, with HSBC, Citibank, Barclays, the Post Office and the Cooperative Bank among the banks also attracting high levels of social media criticism.

The social media audit found the average waiting time for customer queries to be answered by phone was 35 minutes, with some customers waiting more than an hour for a response. The research found that with waiting times, feelings of disgust increased by 84 per cent, with anger increasing by 74 per cent, when related to wait times.

Understanding what drives customer emotions must be the starting point for all banks. Customer loyalty is key and emotion analysis unlocks the reasons why customers may switch banks. Competition across UK banks is increasing. During the six months of our study more than 400,000 people decided to move their current accounts elsewhere.

Banks will increasingly aim to create and compete for customer emotional reactions that inspire loyalty. The challenge is to achieve this for those customers who have adapted to digital online advances, and others who continue to rely on the time-tested advantage of one-to-one telephone interactions.

The customer experience index for UK high street banks was compiled by Adoreboard in collaboration with leading digital agency, Zone Digital.

Jonathan Simmons, Chief Strategy Officer at Zone and an advisor to global brands on customer experience, has said that the findings confirmed the need for banks to refine relationships with customers.

“We are often asked about customer experience, to us it means that at every interaction the experience must live up to the promise your brand has made. If this is not true the gap between your brand promise and a customer’s experience will cause problems.”

“Banks that put customers first understand that the emotional response to every interaction is absolutely vital. In a world where customer experience is becoming the brand differentiator, the best customer experience brings together content, products and technology in a way that is highly relevant and fits brilliantly into the customer’s daily life.”

If you would like to access the full report of the Adoreboard Customer Experience Index: UK High Street Banks or order a Emotion Analysis scorecard for any bank, click here.

Adoreboard has created a way to use analytics to gain insights into people’s emotional reactions online. Our emotion analysis software that can help quantify how the world feels about your brand. Watch this short video to find out more about our Emotics platform: